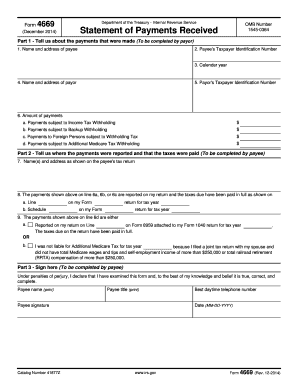

Get the free form 4669 instructions

Get, Create, Make and Sign irs form 4669

Editing irs form 4669 instructions online

How to fill out form 4669 instructions

How to fill out form 4669 instructions:

Who needs form 4669 instructions:

Video instructions and help with filling out and completing form 4669 instructions

Instructions and Help about form 4669 instructions

Hi in this video I am going to explain receives and payments are count up so before that if we explain about the basic concept of nonprofit organization, so generally the business consent can be classified into two categories one is trading unman and the one is non trading concerned, so training consent means the ultimate objective is to earn profit or to maximize the profit for their bonuses so in order to make profit up they'll sell the goods and services to the customer by way of in order to maximize their profit, so there is a main objective of trading concern non-trading organization means it is just opposite of trading consent so non-trading means their ultimate objective is to rent service to the society to meet some social desirable goods or to rent service to its member it is for it is also the way Scott is non-profit-making, so the non trading concern also called as non-profit organization in trading are gone, so we need to have three things while they prepare final account the final of one consists of three part ones is trading account second one is profit and loss of God and third one is balance sheet these are the three divisions in trading account so in order to know the trade result so in trading account we used to record opening stock the purchase of raw material and all direct expenses will become under debit said of trading account in through it said of trading oven we used to record sales closing stock all these things will be recorded in credit say of trading account with that we can know the trade result that is gross profit or loss after finding gross profit of gross loss the second step is preparing profit or loss account with the help of profit and loss upon what you can know the financial position of the company whether the company incurred profit or loss that can be ascertained with the help of profit and loss account, and finally they will prepare balance sheet means in order to know the state of affair of the company, so these are the three divisions which comes under final account of trading concern that is profit making concerned profit oriented concern now look at the non trading organization so non trading organization means example education institution sports club hospitals charitable institution religious institution all this organization being non-profit seeking do not prepare profit and loss account so profit and loss of on trading and balance it is preferred by the trading concern but this profit and loss one is not applicable to non training organization why because their objective is not making profit even, so they would like to know whether their current expenses are being met out of their current income so they also know whether they have sufficient cash balances or not for that purpose they need to prepare final account of final accounts of nonprofit organization okay so when you prepare final accounts for nonprofit organization first step is a recipient payments are found in profit organization in...

People Also Ask about

Is there a new W9 form for 2023?

What is the difference between W9 Form 2023 and w2?

Is W-9 updated every year?

What is the newest W9 form?

How to fill out W9 form 2023?

What is the meaning of W9 form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 4669 instructions?

How do I edit form 4669 instructions straight from my smartphone?

How do I edit form 4669 instructions on an iOS device?

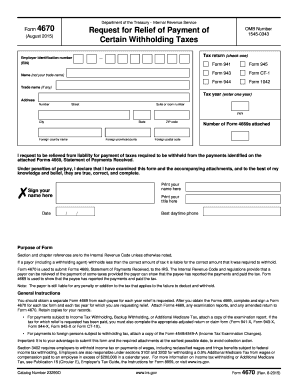

What is 4669 form?

Who is required to file 4669 form?

How to fill out 4669 form?

What is the purpose of 4669 form?

What information must be reported on 4669 form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.